Thematics Asset Management draws the public's attention to the impersonation of its identity and the identity of some of its staff members, including by the use of e-mail addresses not ending by thematics-am.com.

Responsible investing framework

Sustainability approaches

Our RI Framework incorporate multiple strategies that are aligned with established and well-defined sustainability strategies.

These strategies include:

- • Sustainable/positive thematic investing

- • Exclusion [Product-based]

- • Norms-based screening [Behavior-based]

- • ESG Integration

- • Voting & Engagement

These are binding elements and are applied across the investment process – when we Define the theme and its boundaries, when we Select the securities to comprise the investable universe, during the final security Selection for the portfolio, and post-investment. Our governance is in place and our policy framework is welldefined and continuously reenforced.

Contributing to Environmental and social goals through sustainable posive thematic investing

Sustainable or positive thematic investing is investing in themes or assets that are building solutions to address environmental and social concerns. Defining our thematic funds and their scope include looking out for themes that also relate to sustainable development and selecting companies whose solutions are solving specific sustainability challenges, for example enabling sustinable management of finite water resources, promoting good health and well-being, and achievening adequate and safe living standards.

Minimising adverse impact through product and behaviour-based exclusion

As a sustainable and responsible investor, we seek to lower if not eliminate our adverse impacts to society and the environment. Using a combination of third-party data from established ESG rating and research agencies and our own internally set ESG definitions and risk materiality assessment, we systematically screen all of our strategies for any exposure to activities that have negative impact from a sustainability and/or ethical perspective. In addition, Thematics AM also excludes companies that have exposure to high and severe level controversies and those that are considered non-compliant or systemically violate international standards and norms governing corporate behaviour. The table below outlines Thematics AM’s global minimum exclusion criteria and thresholds applied across all our thematicc strategies.

Promoting ESG

Thematics AM has developed a proprietary ESG scoring framework composed of targeted and focused sets of metrics deemed most material to its range of thematic strategies. Our proprietary scoring methodology is a risk-based ESG assessment developed in accordance with established materiality frameworks, such as but not limited to, the Sustainability Accounting Standards Board (SASB) and Global Reporting Initiative (GRI). The Portfolio Managers score individual companies across the 11 different material environmental, social, and governance indicators drawing from a range of resources, including desktop research, company engagement, and ESG risk ratings from multiple rating agencies.

Material ESG Indicators

| Environmental | Social | Governance |

| Climate resilience | Human and labour rights | Board quality |

| Effluents and waste management | Employee safety | Remuneration |

| Environmental impact of products or services | Social impact of products or services | Business ethics |

The total ESG score carries an equal weight (25%) as other investment criteria (i.e. Quality, Trading Risk and Management) and impacts a security’s inclusion and final weight of the investment in the portfolio. The review of the ESG criteria permanently covers at least 90% of the Fund’s net assets. The Fund must also outperform its investable thematic universe. Meeting of these requirements is monitored by the internal Risk and Compliance.

Promoting Good Governance

▪ Through active voting

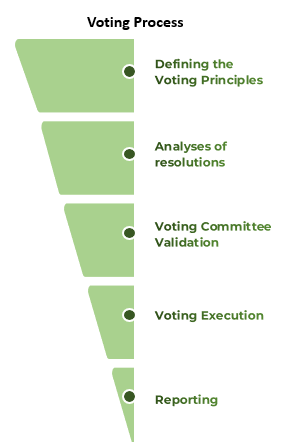

Active ownership through voting and engagement has been a core element of Thematics Asset Management’s responsible investment strategy. As an investor with a long-term horizon, taking active role in the management of the companies we invest in enable us to deliver on our fiduciary duty through creating sustainable and longterm value – one that generate both financial performance and positive outcomes for our clients and their beneficiaries, and the society and the planet where we operate.

As a responsible investor, we recognise our duties in promoting strong corporate governance within our investee companies. Our objectives for voting is five-fold:

- • Creating long-term value for our stakeholders through the promotion of strong governance.

• Protecting the rights of shareholders.

• Promoting a fair and equitable compensation policy for all stakeholders.

• Establishment of strong accountability and transparency.

• Respecting and preserving the environment and society

Guided by these objectives, we have defined our voting principles across what we consider as core governance issues. THEMATICS AM intends to exercise 100% of the voting rights on the issuers of the securities it holds in the portfolios of the strategies it manages, with no geographical restrictions or minimum holding requirements on the exercise of these rights.

Access our Proxy Voting Dashboard in this link.

▪ Through targeted engagement

Good governance enables companies to more clearly assess the risks they face and thereby improve their performance over the medium and long term. As investors, we view engagement as a core strategy through which we can deliver on our fiduciary duty to our clients. Thematics AM therefore engages with its investee companies to achieve the following objectives:

- Risk Management - For investors, relevant and reliable information on companies' management and performance is critical to a fully informed investment decision. Sustainable development issues are becoming drivers of risks. Integrating environmental and social factors into the core of corporate strategy equips companies better for the long-term.

- Long-term value creation - As investors, we recognise our role as stewards of the economy. We will engage with our investee companies with the aim of creating long-term value for our clients and the broader economy.

- Sustainable outcomes - Some of the sustainability challenges faced by the world today represent risks of critical magnitude. Continued destruction of our biodiversity and ecosystems have led to catastrophic events that we have witnessed in recent years, from wildfires, floods and severe droughts, to the Covid-19 pandemic. Changes in current business practices are needed to build mitigation and adaptation capabilities to minimise the risks of future episodes and to build resilience.

For each of the three engagement objectives, we have also defined the targeted results from our investee companies.

- Transparency - To enable our risk management objectives, our engagement with investee companies is aimed at building transparency, primarily on material environmental, social, and governance metrics. As a longterm investor with the majority of companies across our strategies belonging to the middle and small capitalisation groups, engaging for transparency serves to establish strong governance practices at the critical stage of growth of our investee companies.

- Strong Governance - Creating long-term value rests upon the institutionalisation of sustainability values at the core of companies' governance. To help build the governance structures that integrate the interests of all stakeholders, our engagement will focus on the establishment of sustainability governance across our investee companies.

- Actions on critical sustainability challenges - With the urgency of climate and biodiversity issues becoming increasingly evident, the aim of our engagement around sustainable outcomes is to elicit tangible actions from our investee companies. Having assessed the risk management-preparedness level of our investee companies, we have determined that the ideal starting point is for companies to acknowledge and recognise the impact that climate change and biodiversity losses will have on their operations and businesses.

Subscribe to our newsletter

Receive everything the team’s working on directly in your inbox.

Contact us

Our team is here to provide you with personalized and outstanding service.