Thematics Asset Management draws the public's attention to the impersonation of its identity and the identity of some of its staff members, including by the use of e-mail addresses not ending by thematics-am.com.

Responsible investing at Thematics AM

Our conviction – thematic investing done responsibly generates sustainable outcomes

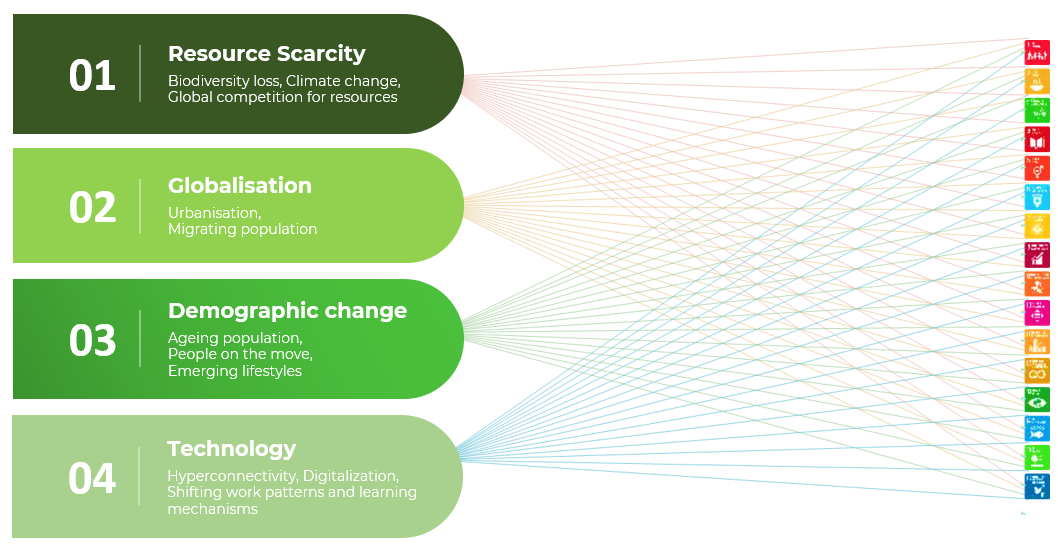

The mainstreaming of sustainable investing in recent years spurred by regulatory developments, especially in Europe, has also pushed thematic investing into the spotlight. Investors’ preference for thematic is growing, in particular for sustainable thematic funds focusing on the UN Sustainable Development Goals - a set of 17 goals around key development areas, including hunger, water, climate, innovation, among others. At Thematics AM, it is our view that thematic investing is inherently tilted towards sustainable investing. Investing in the megatrends transforming our daily lives today is investing in the solutions that are addressing the challenges the planet and humanity is facing.

Scarcity of resources as a result of overextraction to power economic growth and provide for the almost 8 billion population is now fueling innovation in technologies for resource-efficient, cleaner, and more resilient solutions in agriculture and key industries. Rapid urbanisation resulting from population growth and improvements in education have pushed people into cities and urban centres in pursuit of better lives. This fueled the advancements towards smart, connected, and sustainable urban infrastructure to maintain cities' livability. It has also given rise to emerging patterns of behaviors and value systems - around food preferences, fashion, health consciousness, and general living style.

The above are just a few examples demonstrating how structural transformations and megatrends are intricately aligned with the development issues as captured and targeted in the UN SDGs and other social and environmental priorities, for example the EU Social and Environmental taxonomies in support of the European Green Deal.

Why we do responsible investing

- • Contribute to sustainable outcomes while generating (financial) outperformance

Thematics AM manages purely thematic funds to offer asset owners both performance and, where possible, meaning. We believe that we are investing today in the winners of tomorrow. Cognizant of this role as future enablers, generating sustainable outcomes through the themes we select and offer to the market is a fundamental part of our intentionality. All our thematic strategies have direct or indirect positive contributions to multiple sustainability challenges, in particular the sustainable development goals. We invest in long-term themes with the aim of seizing market opportunities while enabling them to grow and respond to global demand. By taking the view that we are investing broadly in innovative solutions that are providing a response for a sustainable future, we aim to contribute positively to the world of tomorrow.

- • Fulfil our fiduciary duty

At Thematics AM, we believe that the integration of sustainability-related factors is essential and critical element of an effective risk management process. It is key to de-risking the portfolios and delivering excess returns. Our fiduciary duty is to generate superior performance for our clients, and it is by integrating material sustainability factors, that we can fully assess and monitor operational, financial, and reputational risks. We are convinced that the consideration of ESG factors supports sustainable value creation for asset owners.

- • Act as stewards

As a responsible investor, we recognize our duties in promoting strong corporate governance within our investee companies. Our objectives for voting are five-fold:

- 1. Creating long-term value for our stakeholders through the promotion of strong governance

- 2. Protecting the rights of shareholders

- 3. Promoting a fair and equitable compensation policy for all stakeholders

- 4. Establishing a strong accountability and transparency

- 5. Respecting and preserving the environment and society .

In addition, we view engagement as a core strategy through which we can deliver on our objectives of contributing to sustainable outcomes, as well as fiduciary duty and risk management. Our engagement priority for 2021-2024 focuses on the following:

- • Transparency

• Strong governance

• Investee actions on critical sustainability challenges: climate change, biodiversity, and human rights

Our sustainability ambitions and commitments

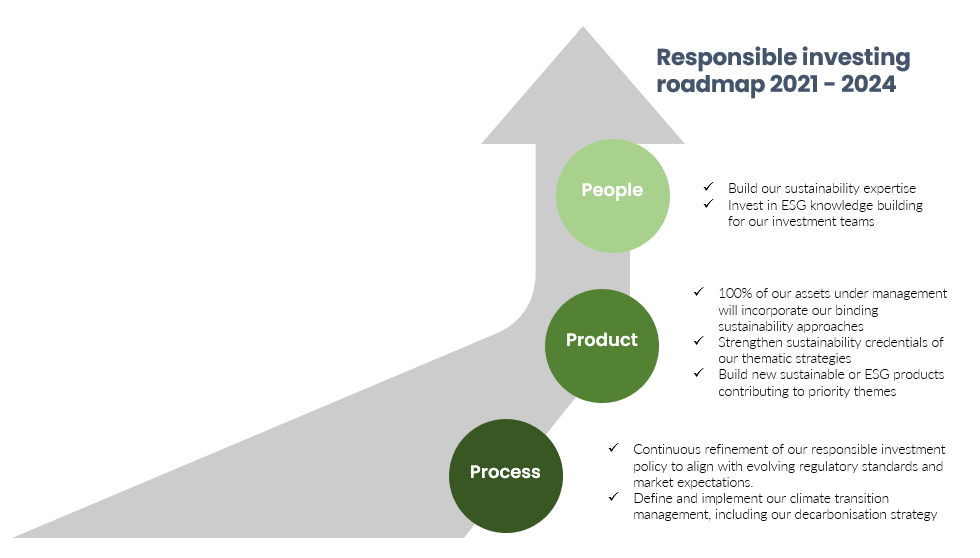

Our 3-year sustainability roadmap [2021-2024], targets to:

1. Build our sustainability expert capability

- ✓ Built a team of sustainability experts to provide guidance and support to the operationalisation of sustainability approaches at fund level by the Investment Team.

- ✓ Continuously strengthen the ESG skills and competency across all business units through relevant trainings

2. 100% of global AUM is sustainable/ESG

- ✓ We achieved this objective – as of April 2021, all our seven thematic strategies are subject to Thematics AM Responsible Investment Policy. Under the EU Sustainable Finance Disclosure Regulation, Thematics AM classified three of its strategies as Article 9 products and four as Article 8 products.

3. Strengthen the sustainability/ESG credentials of our products

- ✓ Obtain independent-third party sustainable product certifications to provide guarantee to the robustness of our responsible investing policy and implementation

4. Continuous process refinement

- ✓ Monitor and maintain the alignment of our responsible investing framework with evolving regulatory standards and market expectations

5. Climate and biodiversity

- ✓ Define the organization's decarbonization strategy

- ✓ Reenforce our climate and biodiversity risk assessment

Subscribe to our newsletter

Receive everything the team’s working on directly in your inbox.

Contact us

Our team is here to provide you with personalized and outstanding service.