Thematics Asset Management draws the public's attention to the impersonation of its identity and the identity of some of its staff members, including by the use of e-mail addresses not ending by thematics-am.com.

Being Responsible

“At Thematics AM, we welcome the acceleration of sustainable finance. It is a validation of our belief in positive returns through positive investing. Being responsible is in our DNA - we founded Thematics with a clear recognition of the long-term value that we could create through our deep thematic investing expertise and at the same time, the opportunity that it presents to generate positive and meaningful contributions, direct or indirect, to the society and to the planet.”

Your thematic experts - investing responsibly for the future, today

It is our conviction that thematic investing is inherently tilted towards responsible and sustainable investing. With thematic investing, we invest in the future, today. We invest in the new technologies that are addressing resource scarcity. We identify new and emerging, more responsible lifestyle, driven by demographic changes. We look for innovative solutions that enable more sustainable use of limited natural resources. This is the goal of sustainable investing, redirecting theflow of capital towards greener and inclusive economy, and this is what thematic investing enables.

Founded in late 2018, we build upon the decades-long experience in thematic investing of its veteran founding partners, all of whom have established reputation and proven track record in the industry. We also leverage on the established brand, capability, and network of our parent company, the Natixis Investment Managers, one of the world’s largest asset management firms(USD 1.4 trillion / EUR 1.2 billion AuM).

And because RI has been part of our investment philosophy from the start, alongside targeting secular growth drivers, being focused, and being unconstrained, we are today, equipped to effectively navigate the rapidly evolving regulatory and normative standards around sustainable investing. More importantly, we are strongly positioned to capture growing opportunities in this space.

Well-defined RI framework that are binding elements of the investment process

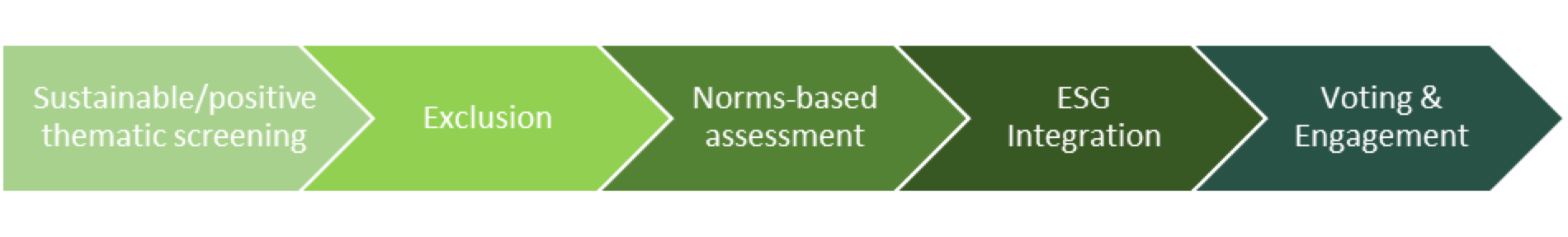

Our RI Framework incorporate multiple strategies that are aligned with established and welldefined sustainability strategies. These include: Sustainable/positive thematic investing, Exclusion, Norms-based screening, ESG Integration, and Voting & Engagement.

These are binding elements and are applied across the investment process – when we definehe theme and its boundaries, when we Select the /securities to comprise the investable universe, during the final security selection for the portfolio, and post-investment.

Sustainability is primarily owned by the Portfolio Managers

At Thematics, Portfolio Managers primarily own the sustainability of the fund that they manage. This means that they carry out the sustainability analyses of the companies alongside the financial analyses, supported by our sustainability experts. We believe that this system of direct ownership ensures that sustainability becomes an integral part of the bottom-up analyses and that PMs have a clear view of the ESG risks and opportunities of the companies that they invest in, and therefore are fully accountable of the investment decisions that they make.

Independently certified sustainable investment credentials

Our products have been awarded two labels to date – French Label ISR (Socially Responsible Investment Label) and the Belgian ‘Towards Sustainability’ product label. They are the among the strictest sustainable product labels existing today. Both labels provide guarantees to investors that awarded funds comply with a strict set of sustainable and socially responsible investment (SRI) criteria. These serve as an endorsement of our strong commitment to sustainability and the process we put in place to achieve it.

Active industry engagement

As investors, engaging with the investment community, with our responsible investor peers is an effective means for collective impact.

Subscribe to our newsletter

Receive everything the team’s working on directly in your inbox.

Contact us

Our team is here to provide you with personalized and outstanding service.